WELCOME TO!

SME Business Accountants

Unlock the full potential of your business with SME Business Accountants.

We provide tailored financial solutions and expert advice to help you achieve sustainable growth and lasting success.

ABOUT US

Client-Centric Support

At SME Business Accountants, we are dedicated to a client-centric approach that prioritizes your needs and success.

We take pride in providing exceptional customer support and customized financial solutions designed specifically for your business.

Your success is our success, and we are here to guide you every step of the way.

Whether you have questions, need expert advice, or require tailored services, our team is just a call or email away, ready to support you in achieving your goals.

OUR SERVICES

High Quality Services

Accounting

At SME Business Accountants, we offer comprehensive accounting solutions to help you stay on top of your financial obligations and compliance requirements. Our services include:

Annual Financial Statements: Accurate preparation of year-end financials to ensure compliance and transparency.

Monthly Management Accounts: Stay informed with detailed reports that help you make data-driven business decisions.

VAT, PAYE, UIF, SDL & WCA Returns: Seamless completion and submission of your returns to SARS, ensuring timely compliance.

VAT, PAYE, UIF & SDL Registration: Expert assistance with business registrations for tax and payroll systems.

PAYE Bi-Annual Reconciliation: Comprehensive reconciliation to keep your business compliant with tax regulations.

Financial Statement Review & Compilation: We review and compile your financials with precision, ensuring they meet all necessary standards.

Accounting Procedures Review: Improve efficiency by reviewing and refining your internal controls and systems.

Computerized Accounting Systems: Implement or upgrade your digital accounting tools for better accuracy and ease of use.

Staff Training & Support: Empower your team with the knowledge and skills to maintain your financial records.

Bookkeeping & Payroll: Reliable and accurate management of your day-to-day financial transactions and payroll processing.

Read More

Annual Financial Statements: Accurate preparation of year-end financials to ensure compliance and transparency.

Monthly Management Accounts: Stay informed with detailed reports that help you make data-driven business decisions.

VAT, PAYE, UIF, SDL & WCA Returns: Seamless completion and submission of your returns to SARS, ensuring timely compliance.

VAT, PAYE, UIF & SDL Registration: Expert assistance with business registrations for tax and payroll systems.

PAYE Bi-Annual Reconciliation: Comprehensive reconciliation to keep your business compliant with tax regulations.

Financial Statement Review & Compilation: We review and compile your financials with precision, ensuring they meet all necessary standards.

We also provide:Accounting Procedures Review: Improve efficiency by reviewing and refining your internal controls and systems.

Computerized Accounting Systems: Implement or upgrade your digital accounting tools for better accuracy and ease of use.

Staff Training & Support: Empower your team with the knowledge and skills to maintain your financial records.

Bookkeeping & Payroll: Reliable and accurate management of your day-to-day financial transactions and payroll processing.

Taxation

At SME Business Accountants, we simplify tax management for businesses and individuals, ensuring full compliance with SARS regulations. Our taxation services include:

Read More

Income Tax Returns: Expert completion and submission of returns via e-filing.

Tax Liability Calculations: Accurate calculation of your tax obligations to avoid overpaying.

Provisional Tax Submission: Timely calculation and submission of provisional taxes.

Salary Structuring: Optimize your tax savings with strategic salary structuring.

Income Tax Registration: Hassle-free registration for your business or personal income tax.

Tax Advisory: Guidance on legislation and various tax forms to ensure compliance and savings.

We also provide:

VAT Registration: We handle your business’s VAT registration with ease.

Employee Tax Exemption Certificates: Assistance with obtaining exemptions for employee tax.

Income Tax Exemption Applications: Help with applying for income tax exemptions.

Tax Assessment Reviews: Thorough checking of your Income Tax assessments.

Customs & Excise Registration: Seamless registration for import/export operations.

Deferred Payment Arrangements: We negotiate deferred payment options when needed.

Tax Objections: Professional representation to handle any tax objections with SARS.

Bookkeeping & Secretarial Services

At SME Business Accountants, we handle all your corporate governance needs, ensuring your business remains compliant with the latest regulations. Our Company Secretarial Services include:

Read More

Company Registrations: Quick and hassle-free company formation and registration.

Shelf Companies: Ready-to-go shelf companies for immediate use.

Appointment of Auditors & Accounting Officers: We manage the appointment process for auditors or accounting officers to meet statutory requirements.

Director Appointments: Seamless appointment or removal of directors for your company.

Share Register Maintenance: We ensure accurate records of all shareholding details.

We also provide:

Member & Trustee Appointments: Efficient management of new appointments for companies and trusts.

Share Transfers & Allotments: Professional handling of share transfers and new share allotments.

Year-End Changes: Adjust your company’s financial year-end with ease.

Special Resolutions: Assistance with drafting and filing special resolutions.

CIPC Changes: All other required updates and submissions to CIPC handled swiftly and accurately.

Business Advisory

At SME Business Accountants, we offer expert advice to help your business thrive. Our Business Advisory Services include:

Read More

Corporate Governance / King III Compliance: Guidance on implementing best practices in corporate governance to meet King III standards.

Risk Management: Proactive identification and management of risks to safeguard your business’s future.

Internal Audit: Comprehensive internal audit services to ensure operational efficiency and regulatory compliance.

Professional Business Advice: Tailored advice on strategic planning, financial management, and business growth.

Our Leadership

Welcome to SME Business Accountants

Dear Clients, Partners, and Friends

At SME Business Accountants, we are dedicated to empowering your business with tailored financial solutions. Our expertise in tax planning, SARS compliance, and financial management allows you to focus on growing your business while we handle the numbers.

By partnering with us, you gain a trusted advisor committed to optimizing your profits and ensuring compliance with all regulations.

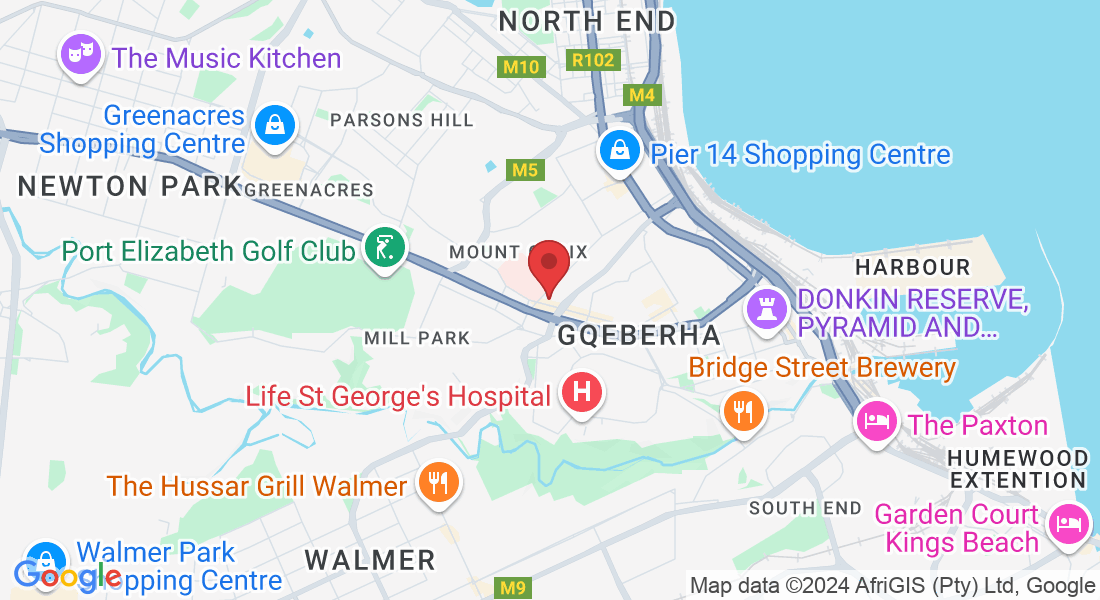

We take pride in transforming lives and fostering financial prosperity, not only for our clients but for the Port Elizabeth business community as a whole.

Let’s work together to unlock new opportunities for success!

Siphosethu Smetu

FAQS

What services does SME Business Accountants provide?

At SME Business Accountants in Port Elizabeth, South Africa, we offer comprehensive accounting services tailored for small and medium enterprises (SMEs).

These include bookkeeping, tax planning, financial statement preparation, SARS compliance, and business advisory services.

Our goal is to help you streamline your finances and focus on growing your business. in Port Elizabeth, South Africa, we offer comprehensive accounting services tailored for small and medium enterprises (SMEs).

These include bookkeeping, tax planning, financial statement preparation, SARS compliance, and business advisory services. Our goal is to help you streamline your finances and focus on growing your business.

Why should I hire an accountant for my small business in Port Elizabeth?

Having a local accountant is essential to navigating the complex tax and compliance landscape in South Africa.

Our expertise helps you save time, reduce costs, ensure compliance with SARS regulations, and offer guidance to enhance your profitability.

Plus, we understand the unique challenges of SMEs in Port Elizabeth, giving you personalized advice.

How can an accountant help me save on taxes?

Our tax experts use effective tax strategies to minimize your tax liabilities legally.

By ensuring you leverage all available tax deductions and incentives, we help you retain more profit.

We also manage timely and accurate SARS submissions, so you avoid costly penalties.

How do I choose the right accountant in Port Elizabeth?

Our team is composed of qualified professionals with extensive experience in SME accounting.

We focus on building strong relationships with our clients, offering personalized, hands-on service.

Our expertise and local knowledge of the Port Elizabeth business landscape make us the perfect partner for your business.

How can an accountant help my business grow?

Beyond compliance and tax savings, we offer strategic financial advice to help your business grow.

From budgeting and forecasting to cash flow management, our accountants in Port Elizabeth provide insights that help you make informed decisions and scale your business

OUR TESTIMONIALS

Client's Feedbacks